Commercial real estate depreciation calculator

Use a House Depreciation Calculator. The long-term goal of the company is to transition toward 95 of franchised restaurants in 2020 franchised restaurants were 93 of the total.

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

In 2021 over 56 of the total revenues came from franchised restaurants.

. Add your information in the green boxes to instantly calculate the ROI cash flow and IRR. Familiarizing yourself with all the perplexing subtleties its a smart thought to let your tax programming or bookkeeper handle the computations for you. For example the Washington Brown calculator features each of the alternatives mentioned.

This self-employed status allows you to deduct many of the. The company generated over 23 billion in revenues in 2021 of which 978 billion from owned. The ATO states in taxation ruling 9725 that quantity surveyors such as BMT Tax Depreciation are one of the only recognised professions with the appropriate construction costing skills to estimate.

BMT Tax Depreciation works with your accountant to ensure that your depreciation claim for your investment property is maximised each financial year. Cap rates in high-demand areas will be lower than those in less densely-populated areas. You just might find it to.

Bonus depreciation has been changed for qualified assets acquired and placed in service after September 27 2017. Another option is to use a house depreciation calculator. In terms of law real is in relation to land property and is different from personal property while estate means.

Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate. NW IR-6526 Washington DC 20224. When Does Property Depreciation Start.

Youre generally not considered an employee under federal tax guidelines but rather a self-employed sole proprietor even if youre an agent or broker working for a real estate brokerage firm. July was the first month that interest rates stayed above 4 percent for the entire month since September 2014. Get a great deal on a great car and all the information you need to make a smart purchase.

Systems such as a home depreciation calculator are currently put in place to make sure you are depreciating your own asset accordingly. Real estate economics is the application of economic techniques to real estate marketsIt tries to describe explain and predict patterns of prices supply and demandThe closely related field of housing economics is narrower in scope concentrating on residential real estate markets while the research on real estate trends focuses on the business and structural changes affecting. That means at a high level the commercial real estate appraiser must.

Section 179 deduction dollar limits. Commercial real estate appraisers must be skilled at evaluating a wide variety of property types. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

What Is Commercial Real Estate. Commercial Sales Consultant email protected 08 9192 2000. Use our depreciation recapture tax calculator to determine the amount youll be taxed on the sale of your rental property and find out how to avoid depreciation recapture using a 1031 exchange.

Get 247 customer support help when you place a homework help service order with us. Immovable property of this nature. Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. For commercial buildings the term is 39 years. First National Real Estate Broome offer real estate for sale in Broome Cable Beach.

Browse Commercial Sale Properties. This comprehensive guide explains how to avoid or reduce capital gains tax CGT when selling a commercial property. Additionally most of the time when youre signing the Contract of sale of real estate the depreciation deduction is already calculated into the total price.

Browse Commercial For Lease. To be certain I recommend hiring a trained tax professional. What is a good cap rate in commercial real estate.

It includes offices industrial units rentals and retail. We welcome your comments about this publication and your suggestions for future editions. Real Estate ABC - Information on Buying and Selling A Home Interest Rate Report - Jul 2015.

Search for property with First National Mudgee. Get 247 customer support help when you place a homework help service order with us. Adjust any of the inputs and the results will instantly update to reflect the changes.

Additionally commercial real estate can be deducted over a 39 year period. Analyze the value of purchasing an investment property or renting your home or condo with the calculator below. Inflation can also play a role in increasing a propertys value.

Long-term mortgage interest rates continued their move to record highs for 2015 according to data from mortgage finance company Freddie Mac. While bonus depreciation has become a popular tool for real estate investors especially. Normally you will encounter a capitalization rate between 400 and 1000 for commercial property.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Real Estate Investment Calculator.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. The results will display the minimum and maximum depreciation deductions that may be available for your investment property between 1 and 5 full years. Understand the propertys intended use its relevant characteristics and whether it is under assignment to third parties.

An interest vested in this also an item of real property more generally buildings or housing in general. The old rules of 50 bonus depreciation still apply for qualified assets acquired before September 28 2017. Commercial real estate is property used for business purposes rather than as a living space.

Location development and improvements are the primary ways that residential and commercial real estate can appreciate in value. These assets had to be purchased new not used. We will discuss such effective and legal methods as 1031 tax-deferred like-kind property exchange 1033 exchange of condemned property how to comply with the sections 721 and 453 tax benefits of opportunity zones when selling commercial real.

So in real estate the estimated asset lifespan is from 15-20 years for improvements while a residential rental property stands at 275 and 39 years for commercial property. Find new and used cars for sale on Microsoft Start Autos. Buy sell and rent real estate in Mudgee Kandos Dunedoo and surrounding suburbs.

The Overall Commercial Real Estate Appraisal Process. Most real estate agents and brokers receive income in the form of commissions from sales transactions. McDonalds is a heavy-franchised business model.

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator With Formula Nerd Counter

1 Free Straight Line Depreciation Calculator Embroker

Straight Line Depreciation Calculator And Definition Retipster

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator Depreciation Of An Asset Car Property

Free Macrs Depreciation Calculator For Excel

Double Declining Balance Depreciation Calculator

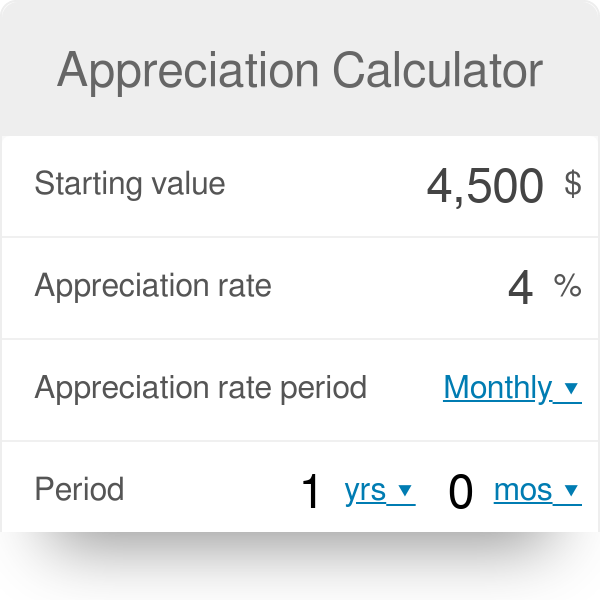

Appreciation Calculator

Depreciation Of Fixed Assets In Your Accounts Marketing Process Accounting Small Business Office

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Calculator Download Free Excel Template

What Is A Property Depreciation Calculator It Helps You To Estimate The Likely Tax Depreciation Benefit Investing Investment Property Loan Repayment Schedule

Straight Line Depreciation Calculator And Definition Retipster

How To Use Rental Property Depreciation To Your Advantage

Depreciation Schedule Template For Straight Line And Declining Balance

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business